- 2 Nov 2025

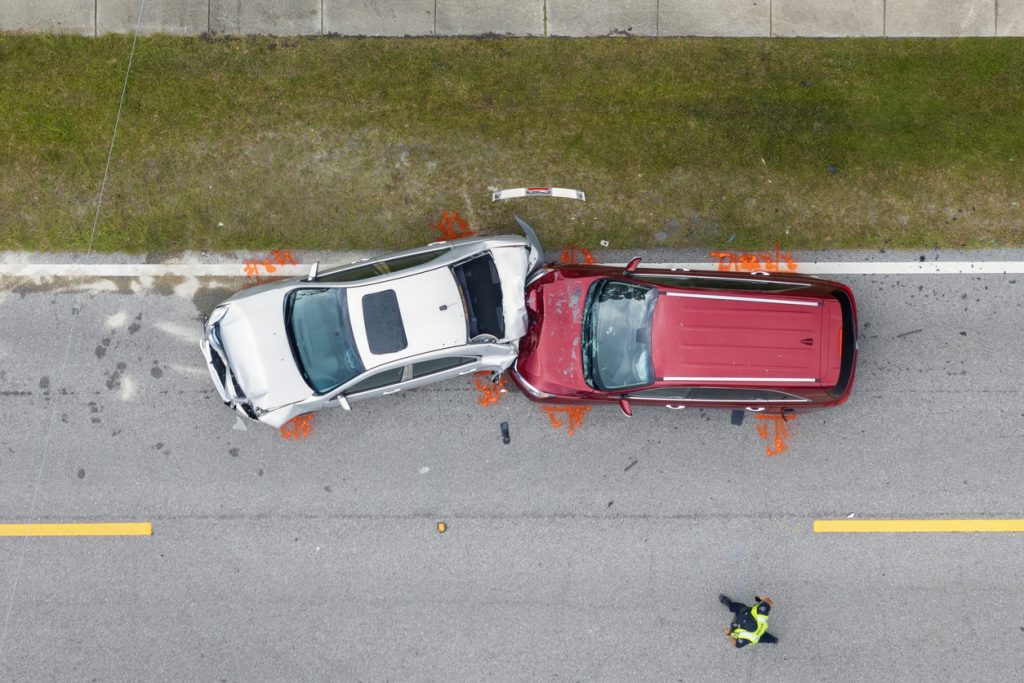

When someone is sued after car accident in Oklahoma, the first concern often revolves around insurance coverage and financial responsibility. Oklahoma follows a fault-based insurance system, which means the driver determined to be at fault is financially liable for damages. Because lawsuits can result in significant costs, it is crucial to understand how insurance functions in these scenarios and what role it plays in protecting drivers from personal financial ruin. This guide explores in detail the relationship between lawsuits and insurance, providing clarity on what happens when litigation enters the picture.

Understanding Liability When You Are Sued After Car Accident in Oklahoma

Liability in Oklahoma is grounded in the fault system. If you cause a collision, you are legally responsible for covering the damages of others involved. When the situation escalates to being sued after car accident in Oklahoma, the plaintiff is essentially seeking compensation for damages that exceed what has already been recovered from insurance claims. The lawsuit can involve medical expenses, lost income, property damage, or non-economic damages such as pain and suffering.

In these cases, your insurance company has an immediate role in determining the extent of coverage and whether defense costs are provided. Policies typically include liability limits, and once those limits are exhausted, any additional award from a court judgment may become your personal responsibility.

The Role of Auto Insurance in Oklahoma Lawsuits

Oklahoma requires all drivers to maintain minimum liability insurance coverage. The mandatory limits are designed to cover bodily injury and property damage, but they may not always be sufficient in serious accidents. When an individual is sued after car accident in Oklahoma, the insurance provider usually becomes the first line of defense.

Insurance typically functions in two ways during a lawsuit. First, the insurer provides legal defense, including hiring an attorney to represent you. Second, the insurer pays settlements or judgments up to the coverage limits. Once those limits are exceeded, you may need to rely on personal assets or additional policies such as umbrella insurance.

Insurance Company’s Duty to Defend and Indemnify

When a driver is sued after car accident in Oklahoma, the insurance company’s obligations are twofold: defend and indemnify. The duty to defend means the insurer must provide legal representation, even if the lawsuit is ultimately groundless. The duty to indemnify refers to the obligation to pay valid claims up to policy limits.

It is important to recognize that insurers have a strong incentive to resolve claims within the coverage limits to avoid exposing their policyholders to excess liability. If they fail to act in good faith, the policyholder may have grounds to pursue additional legal action against the insurer.

Settlement Negotiations When You Are Sued After Car Accident in Oklahoma

Many lawsuits never reach trial because settlement negotiations resolve disputes. If you are sued after car accident in Oklahoma, your insurance company often takes the lead in negotiating with the plaintiff’s legal representation. Insurers aim to minimize payouts while avoiding costly litigation, which may work in your favor if the settlement falls within coverage limits.

However, settlement can become complicated when the damages claimed far exceed policy coverage. In such cases, plaintiffs may be unwilling to settle within insurance limits, creating the possibility of a personal judgment against you. This is where umbrella policies or personal financial arrangements become critical to avoid long-term financial consequences.

Excess Judgments and Personal Financial Risk

One of the greatest risks when being sued after car accident in Oklahoma is the possibility of an excess judgment. This occurs when a court awards damages beyond the amount covered by insurance. For example, if your liability limit is $50,000 but the court awards $200,000, you are personally responsible for the $150,000 difference.

To mitigate this risk, some drivers purchase umbrella insurance, which provides extended coverage above the limits of standard policies. Without additional protection, assets such as property, savings, or future wages may be at risk of garnishment.

Comparative Negligence and Its Effect on Lawsuits

Oklahoma applies a modified comparative negligence rule. This means that if you are sued after car accident in Oklahoma, your liability may depend on your percentage of fault. If you are found 50% or more at fault, you cannot recover damages from others. Conversely, if you are less than 50% at fault, you may still owe damages, but they will be reduced in proportion to your fault percentage.

Comparative negligence can significantly affect how much your insurer pays out, as well as whether the plaintiff pursues further compensation. Understanding this principle is vital in assessing your potential exposure during litigation.

Steps to Take Immediately If You Are Sued After Car Accident in Oklahoma

Responding appropriately to a lawsuit is critical to protecting both your legal rights and insurance coverage. The first step is to notify your insurance company immediately, as failing to do so could jeopardize your coverage. Insurers typically require prompt notice of lawsuits to prepare a defense strategy.

Additionally, cooperating fully with your insurer’s defense team is necessary to ensure the strongest case possible. This includes providing accurate information about the accident, supplying requested documentation, and appearing at required legal proceedings. Ignoring legal notices or failing to participate could result in a default judgment against you.

If you want more detailed guidance, reviewing resources such as what to do if you are sued after car accident in Oklahoma can provide deeper context on managing the legal process while relying on your insurance coverage.

The Importance of Understanding State Insurance Requirements

Every driver in Oklahoma is required to carry liability insurance, but not every driver fully understands what those requirements mean in practice. Being sued after car accident in Oklahoma highlights the importance of knowing your policy details, including coverage limits, exclusions, and additional protections.

The Oklahoma Insurance Department provides resources on mandatory coverage and consumer rights, which can help clarify what drivers should expect if faced with litigation. For example, the state mandates specific minimum limits, but it also encourages drivers to consider higher coverage amounts for added financial security. Accessing resources such as the Oklahoma Insurance Department ensures drivers remain informed about their rights and obligations under state law.

Insurance Bad Faith and Policyholder Protections

There are situations where an insurance company may mishandle a claim, particularly when a driver is sued after car accident in Oklahoma. If an insurer fails to settle a claim within policy limits when it reasonably could have, and this leads to an excess judgment, the insurer may be liable for bad faith.

Policyholders have legal recourse in such situations, potentially holding the insurer accountable for the full judgment amount. This underscores the necessity of ensuring your insurer is acting in good faith throughout the claims and litigation process.

Final Thoughts on Insurance Protection When Sued After Car Accident in Oklahoma

Navigating lawsuits after collisions is a stressful and complex process, but insurance plays a central role in minimizing financial and legal exposure. When someone is sued after car accident in Oklahoma, their insurer provides both defense and indemnity up to policy limits, though the risk of excess judgments always remains.

By understanding state insurance requirements, monitoring coverage levels, and acting promptly when faced with litigation, drivers can better protect themselves against devastating financial consequences. Reviewing policy terms carefully and considering supplemental coverage can mean the difference between financial stability and long-term hardship after an accident lawsuit.

Recent posts

- 17 Oct 2025

Categories

- Accident & Injury Law (54)

- AI (1)

- Copyright Law (1)

- Criminal & Civil Law (17)

- Disability Law (2)

- Driving Law (2)

- Employment Law (1)

- Estate Planning (2)

- Family & Relationship Law (29)

- Food and Drink (2)

- Gas Exposure (1)

- Health (1)

- Immigration Law (2)

- Injury Claim (1)

- Insurance Law (7)

- Legal (40)

- Lemon Law (4)

- Mediation (3)

- Medical Malpractice (1)

- Property & Business Law (9)

- Severance Agreement (1)

- Travel and Leisure (1)

- Uncategorized (12)

- Worker Compensation (2)